Good morning,

I don’t use a “risk questionnaire” or “risk score” with my clients.

However, if you’ve worked with a financial advisor before, they’ll often ask you to fill out a multiple-choice questionnaire designed to assess your “tolerance for risk.”

Or to assign you a risk number.

The purpose of these assessments is to inform the advisor on how much potential pain you can tolerate in your investment portfolio when - not if - the market declines.

Some call it the “sleep at night” factor – if your investment strategy is so risky that it keeps you up at night, clearly that’s too much risk.

Unfortunately, many of these same questionnaire-wielding advisors will put you in a portfolio that - by its very design - aligns with your maximum tolerance for risk pain.

In plain English, they’re asking how much pain you can handle and then they’ll expose you and your portfolio to that exact amount of pain exposure.

Seems a little barbaric and backward to me. 🤔

I’ve shared some of my thoughts on this before:

Financial advisors should be able to help you understand the concept of risk and how it plays into every aspect of your life and your finances.

The BIG problem lies in the fact that investing and markets are inherently uncertain and no assessment of your tolerance for risk can predict what kind of pain the markets may inflict upon you.

Or how you’ll react when they do.

That’s why it’s hard to tie what is known as asset allocation – the decision on how your funds will be divided across different types of investments such as stocks, bonds, cash, real estate and alternatives – to a simple multiple-choice questionnaire.

Here’s a brief 2008 note I wrote about asset allocation:

The fact is that every kind of investment has its risks, including:

Stocks

Prices for a diversified portfolio of stocks can rise and fall suddenly and severely.

For example, from February 20, 2020, to March 23, 2020, the S&P 500 fell more than 33%.

And from September 30, 2008, to March 9, 2009, the S&P 500 fell over 41%.

Of course, the market can go up quickly as well: from March 23, 2020 to December 31, 2021, the S&P 500 was up over 112%.

Prices for individual stocks can rise and fall even more suddenly. Or they can become worthless. I don’t recommend individual stocks.

Bonds

While generally less volatile than stocks, bonds can lose value as interest rates increase and can also offer returns that often won’t result in real returns after inflation is accounted for

During the calendar year 2022, intermediate (7-10 year) Treasury Bonds fell over 15%.

High quality bonds have, however, historically served as a good shock absorber for the short-term risk in the stock market. (2022 being a notable exception)

Cash

Loses real value (purchasing power) EACH AND EVERY YEAR year because of inflation. This might be the only thing I can guarantee will happen in the future.

Real estate

Suffers from boom and bust cycles and isn’t easy to sell quickly

During the period from September 30, 2008, to March 9, 2009, the US real estate market, as measured by the Morningstar US Real Estate Index, fell over 64%.

You already have more than enough real estate exposure if you own a home, as well as through your diversified stock portfolio which has exposure to plenty of real estate

Alternative investments

Are hard to understand, difficult to sell quickly, often very expensive, and can lose a lot of value in a short period of time

They are completely unnecessary as part of your financial plan

It’s interesting that so many advisors recommend them. I do not.

So what can you do about all these risks?

You sure can’t control ‘em, that’s for sure.

And while it’s always good to diversify, diversification doesn’t always work like we expect it to:

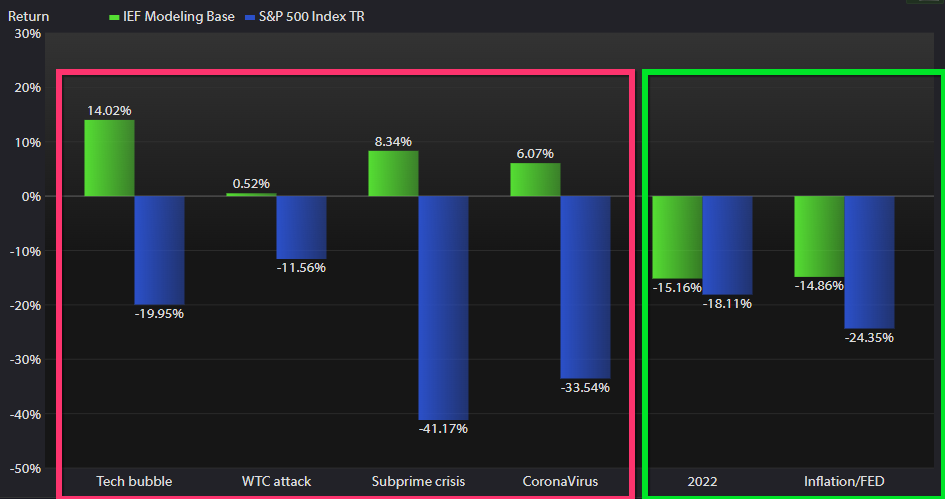

In the image above, the pink box shows different time periods where diversification between stocks (blue) and bonds (green) worked as expected. The green box on the right shows how in 2002, diversification didn’t work as we’d hoped.

There is no way for anyone, even the savviest financial advisor or investment manager, to know what the markets will do 5 minutes from now.

Any attempt to predict what will happen 5 months or 5 years from now is simply a guessing game.

And I don’t know about you, but I don’t think you should base your retirement plan and financial future on a guess.

If we’re talking about a few decades from today, I believe that capitalism will prevail and markets will be much higher than they are today.

But it can be Mr. Toad’s Wild Ride along the way.

While you can’t control investment markets or their inherent risks, that doesn’t mean that you don’t have any control at all.

You have control over the goals you select and the financial advisor you choose to help you realize those goals. Among other things…

As a financial advisor who works with women and believes in and practices lifestyle investing as a core part of your financial plan, it’s my job to help you explore and clarify your goals, figure out where you are financially in relation to those goals and work with you to develop a personalized plan to achieve what’s important to you.

Obviously, any sound financial and investment plan will take into account the risks inherent in investing in stocks, bonds, and other investments.

And the trade-offs among these risks.

But at Wealthcare for Women, I don’t let what the market might or might not do dictate YOUR investment and financial plan.

I work with you to determine your goals, formulate a plan that works for you, and execute that plan, making adjustments as we go through regular planning reviews every few months.

And together we develop a retirement plan and asset allocation that gives you sufficient comfort and confidence in your plan.

In other words, we want to arrive at an investment plan that you can stick with - no matter what - regardless of the inevitable ups and downs we’ll experience along the way.

Your portfolio - and its inherent risks - should be constructed solely in the context of your personal financial plan, including current resources and future needs.

And rather than positioning you - and your money - at your maximum level of pain/risk tolerance, you should only take the level of investment risk needed to comfortably and confidently support your personal planning.

Those risk questionnaires are worthless.

And thankfully, there’s a better way…

What do you think?

How do you consider the different types of investment risk when putting your portfolio and retirement plan together?

Links & Things

I cannot tell you how important it is to regularly review and confirm your beneficiary designations. Whether for your 401k, your IRA, or a life insurance policy, make sure you know where your money will go if when something happens to you.

I’m dealing with this very issue in my own family right now. Thanks to a 2012 Florida statute. Might share more on that later…

For now, read this:

If the Wall Street Journal article link above is behind a paywall (it’s not at the time I’m writing this), then try this link.

Thoughts? Suggestions?

Hit reply or leave a comment and share your thoughts…

Until next Wednesday,

Russ

Amen to this, Russ. Here is my take on MJQs (you'll have to read the squib for the explanation!): https://www.linkedin.com/feed/update/urn:li:activity:7209445840292036608?commentUrn=urn%3Ali%3Acomment%3A%28activity%3A7209445840292036608%2C7209527471463903233%29&dashCommentUrn=urn%3Ali%3Afsd_comment%3A%287209527471463903233%2Curn%3Ali%3Aactivity%3A7209445840292036608%29